| Key actions | |

|---|---|

|

We made an industry standard to enhance protections for telco customers who are (or may be) experiencing financial hardship. |

|

We published the December 2023 telco complaints-handling performance data. The data shows that Australian telcos received 236,873 complaints, which is 21.7% lower compared to the same quarter the previous year. |

|

One telco paid a $1,501,500 infringement notice and entered into a court-enforceable undertaking after it failed to comply with public safety rules. |

|

We directed a telco to comply with Telco Consumer Protections Code (TCP Code) rules about obtaining and recording a customer’s consent to a transfer from another telco. |

|

We directed a telco to comply with TCP Code rules about properly training their sales reps in how to sell services responsibly. |

Consumer protections in direct regulation

On 1 February 2024, we made the Telecommunications (Financial Hardship) Industry Standard 2024. The standard commenced on 29 March 2024.

The standard was developed to improve safeguards for telco customers having financial difficulties.

The new standard requires telcos to make and promote accessible financial hardship policies. Telcos must do more to identify customers in financial hardship and prioritise keeping them connected to services.

Before disconnecting a customer’s service, telcos must work out if they are experiencing financial hardship. If so, telcos must help keep the customer connected.

The new rules replace and improve previous financial hardship measures in the TCP Code. We have also produced information for industry and consumers to raise awareness of the new rules.

Find out more about the new standard.

Telco compliance activities: 2023–24 compliance priorities

Protecting telco customers in financial hardship

We continued to prioritise telco customers experiencing financial hardship. This includes focussing on how telcos comply with their obligations to support these customers.

In March 2023, we launched a social media education campaign, 'Tell your telco – they can help'. It promotes awareness about what consumers in financial difficulties can do to get help. The campaign was relaunched in March 2024 alongside the commencement of the Financial Hardship Standard.

To better support customers who may need financial assistance, telcos are required under the new standard to make a Payment Assistance Policy and have a summary of the policy on their website. We will soon start an audit of industry compliance with these rules.

Where telcos breach the new standard, we can take enforcement action against them, including financial penalties.

Supporting telco customers experiencing domestic and family violence

Telecommunications are an essential service for people. However, for those experiencing (or trying to escape) domestic and family violence, these services can be a lifeline.

Under the TCP Code, telcos must ensure their sales reps and staff can interact with disadvantaged or vulnerable consumers appropriately. The TCP Code advises telcos to utilise the Communications Alliance guideline G660:2023 Assisting Customers Affected by Domestic and Family Violence.

We are focusing on whether telcos are complying with the TCP Code.

Domestic and family violence is an area we are concentrating on as part of the TCP Code review.

We will be paying close attention to how industry is proposing to help protect these vulnerable Australians. We will receive the draft TCP Code in late May.

Combating scams

We continue to take the fight to scammers to disrupt their activities and protect Australians.

Telcos have reported blocking more than 1.9 billion scam calls since December 2020, and more than 533 million scam SMS since July 2022 (to the end of this quarter).

The ACMA and telcos use industry blocking statistics to identify specific and longer-term trends to help inform disruption activities.

We also:

- Expanded the pilot phase of the Sender ID Registry by adding new alpha tags. This helps prevent scammers impersonating business SMS message headers.

- Supported the work of the National Anti-Scam Centre, which was launched by the ACCC on 1 July 2023 under the government’s Fighting Scams initiative.

- Issued consumer alerts about re-emergence of the ‘Hi mum scam’, government ‘cost of living’ impersonation scams, and Do Not Call Register scams.

- Worked alongside telcos, government agencies, international regulators and well-known brands to disrupt phone scams. This included providing data and intelligence products to telcos and government agencies.

Find out more about how to protect yourself from phone scams.

Other telco compliance activities

We started 5 investigations into telco compliance with:

- Emergency Call Service Determination rules that require telcos to comply with Triple Zero (000) requirements.

- TCP Code rules that set out telco requirements to support customers affected by domestic and family violence.

- Rules that specify how telcos must store and protect data.

- Service Migration Determination rules that require telcos to test the speeds of NBN services and take action if speeds don’t meet the customer’s plan speed.

- Legislation that requires telcos to submit an Interception Capability Plan by 1 July each year.

We completed 4 investigations into telco compliance with:

- TCP Code rules that set out telco selling practice requirements.

- Complaint Handling Standard rules that specify how telcos must handle complaints.

- Legislation that requires telcos to comply with the Telecommunications Industry Ombudsman (TIO) scheme.

- Anti-scam rules, including to prevent identify theft.

Our compliance and enforcement outcomes for the quarter included:

- Optus paying a $1,501,500 infringement notice and entering into a court-enforceable undertaking. Optus failed to upload required customer information for close to 200,000 mobile customers (supplied under the Coles Mobile and Catch Connect brands) to the IPND between January 2021 and September 2023.

- Directing Star Telecom to comply with the customer transfer rules in the TCP Code.

- Directing Urban Telecom to comply with the fair selling training requirements in the TCP Code.

We also monitored compliance with 5 court-enforceable undertakings during the quarter. These undertakings set out the actions telcos must take to improve their compliance with telecommunications laws. No compliance issues were identified.

View our finalised investigations into telco providers. Please note that we do not generally publish ‘no breach’ findings or investigation reports before taking enforcement action.

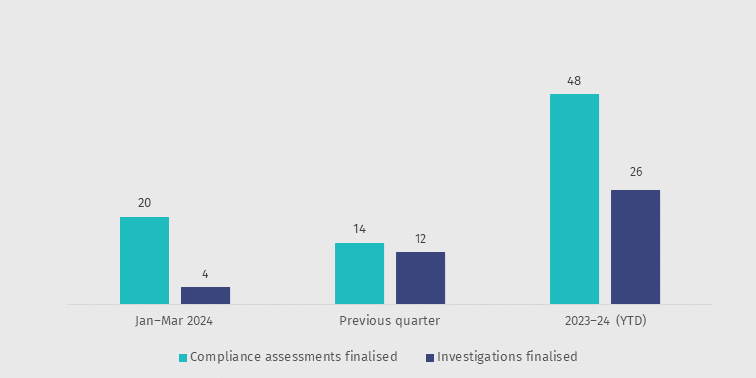

We started 14 compliance assessments and completed 20 compliance assessments into telco compliance with consumer safeguards. These included TCP Code rules.

Completed compliance activities

Telco complaints-handling performance

We released the December 2023 telco complaints-handling performance data. The data shows that Australian telcos received less complaints compared to the December 2022 quarter. The 236,873 complaints were a decrease of 21.7% per cent compared to complaints received in the corresponding quarter in the previous year. This was also reflected in lower complaints per 10,000 services, at 51 for December 2023, down from 67 in December 2022.

However, it took telcos on average 6.4 days to resolve complaints. This was an increase from 4.6 days in the same period the previous year.

Stakeholder forums

The Consumer Consultative Forum (CCF) allows consumer, industry and government stakeholders to meet and discuss telco issues affecting consumers. We hold 2 online meetings each year for the consumer representatives to share information and set CCF meeting agendas.

The consumer representatives met on 28 February 2024. We provided members with an update on the recently released Financial Hardship Standard and plans for the social media campaign and the TCP Code review. We also sought feedback from members on improvements to the CCF and how it can best fulfil its purpose to inform our thinking and assist it in performing its role on matters affecting consumers.

We also welcomed a guest from the First Nations Digital Inclusion Advisory Group, who was able to provide valuable input in developing the education campaign for the Financial Hardship Standard.

The next CCF meeting will be held on 4 June 2024.

Download the data file

Check the accessibility file for the information shown in the chart above.